Long-Term Care Case Study

Maximizing your life after retirement by designing a compelling LONG·TERM CARE plan.

Long-term care includes a vast array of services aimed at helping people when they are no longer able to function independently. The types of long-term care services depend upon the individual’s needs. Some long-term care is aimed at providing help with day-to-day activities for people with chronic illness, or cognitive impairment, such as dementia. Other long-term care services may be rehabilitative, helping someone regain function after a serious injury. It can range from helping with household chores, to assistance with activities of daily living, to highly skilled medical care.

Long-term care services may be provided in a variety of settings such as the home, the community (e.g., adult daycare centers) or in assisted living facilities. The chances of needing home health care are considerably greater than the likelihood of needing nursing home care.

Long-Term Care Insurance

Long-term care insurance is designed to help pay the cost of long-term care services if you need them. Long-term care insurance policies offer a wide range of benefits. Some policies cover only nursing home care, others cover only home health care and still others cover both home health and nursing home care. The ability to receive benefits for home care may allow the care recipient to live independently at home instead of living in a long-term care facility. The cost for these policies will depend on factors such as age, current medical condition, the amount and length of benefits, the elimination period and the types of services covered. Benefits typically begin once the insured can no longer perform a specified number of activities, which is typically 2 or more of the 6 daily living (ADLs), such as bathing, dressing or eating or diagnosed as having a severe cognitive impairment.

Benefit payment methods will vary between expense reimbursement and indemnity plans. Under the expense reimbursement plan, once an insured is eligible for benefits, those benefits will be paid as reimbursement for expenses actually incurred or up to the policy’s monetary limit, whichever is less. Reimbursement plans require the claimant to submit receipts for reimbursement. An indemnity plan pays the maximum daily or monthly benefit when the policy requirements have been met, notwithstanding actual expenses incurred.

Medicare’s and Medicaid’s Limited Coverage

Medicare provides only minimal coverage of nursing home care. The purpose of Medicare, the federal health care insurance for those 65 and older, is to provide for skilled or acute medical care. Medicare may pay for 20 days in a nursing home, plus an additional 80 days subject to a $185.50 (in 2021) deductible per day. The word “may” is used because Medicare will pay only after a three-day hospital stay and only if the beneficiary is receiving skilled care. After 100 days, Medicare will pay nothing for these services. Medicare supplement policies (also known as Medigap) may cover the daily co-pay amount. These policies, however, are not designed to cover long-term custodial expenses. If a beneficiary is receiving only custodial care in a nursing home (i.e., help with bathing, dressing, eating, etc.), then Medicare will not cover any of the costs. Unless long-term care insurance was previously purchased, the only program available to assist in financing nursing home care is Medicaid.

Older individuals with means also cannot rely on Medicaid as the Medicaid program funds health care for the poor. In general, Medicaid will not pay bills until the patient’s savings are depleted. To qualify for Medicaid coverage of nursing home care expenses, a single individual typically cannot own more than $2,000 in “countable” assets ($3,000 for a married couple living in the same household). The starting point in the treatment of assets for married couples is that all assets owned by either spouse are considered available to the institutionalized spouse for purposes of Medicaid. Some assets such as the principal residence, if occupied by the community spouse, are not counted. After adding together all countable marital assets, the state Medicaid agency then determines what share of those assets the community spouse will be allowed to keep. This figure, which is based upon federal and state law, is called the Community Spouse Resource Allowance (CSRA). The exact rules for attributing a couple’s assets vary from state to state, some being more generous than others. There is, however, a federal minimum and maximum CSRA to which all states must adhere. Once receiving Medicaid assistance, the nursing home resident must use his or her income, after certain deductions, to pay for the nursing home. Medicaid pays the balance. The spouse at home does not have to pay any of his or her income to the nursing home.

Many people try to transfer some or all their assets immediately after it has been determined that they will require long-term care assistance. However, the transfer of assets to qualify for Medicaid will often result in a period of ineligibility. In determining Medicaid eligibility, the states will look back to see what disqualifying transfers were made in the 60-month period of time prior to a Medicaid application date (i.e., the look-back period). This means that transfers of certain assets for less than fair market value made during the look-back period will result in a five-year period of ineligibility. More significantly, changes in Medicaid law now mean that the period of time that an applicant will be denied aid begins not from when he or she made the gift but from when the applicant applied for assistance and was otherwise fully qualified.

Income Tax Treatment of Long-Term Care Insurance

A qualified long-term care insurance contract is defined as any insurance contract that provides coverage only for qualified long-term care services and meets certain other requirements as set forth in the Health Insurance Portability and Accountability Act, commonly known as “HIPAA”. Qualified long-term care services are necessary diagnostic, preventative, therapeutic, treating, mitigating and rehabilitative services and maintenance, or personal care services required by a chronically ill individual, and are provided by a licensed health care practitioner.

Individual Taxpayer

A portion of tax qualified long-term care insurance premiums paid by a taxpayer for the taxpayer’s spouse and/or eligible tax dependents is deductible as a personal medical expense if the taxpayer itemizes on Schedule A and his or her total medical expenses exceed 7.5% of adjusted gross income (AGI)1.

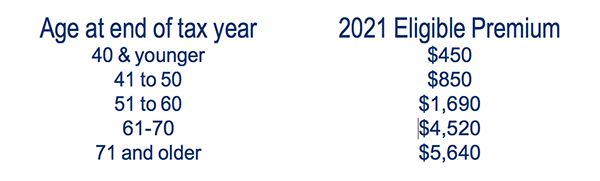

Amounts paid for eligible long-term care insurance premiums are deductible up to certain annual limitations. These limitations are based upon the individual’s attained age before the close of the tax year and are adjusted annually based upon increases in the medical care component of the Consumer Price Index2. These LTCI Eligible Premium limitations for the 2021 calendar year are as follows:

If the taxpayer has a Health Savings Account (HSA) or an employer-funded Health Reimbursement Account (HRA), the taxpayer can pay his or her eligible LTC insurance premiums (or be reimbursed) tax-free from his or her HSA, but only up to the age-based, eligible premium amount.

In addition to the deductibility of the premium, a second advantage of a qualified long-term care policy is that benefits paid by a qualified long-term care insurance policy are generally not taxable as income. For per diem or indemnity type plans, where the full benefit is paid regardless of any expense incurred, the benefits are tax-free up to $400 per day in 2021 even if actual expenses are less. If the benefit is higher than $400/day, the excess is taxable income unless an equal amount of paid care expenses above $400/day can be shown.

Self-Employed Business Owners

An employer can generally deduct as a business expense both the cost of setting up a long-term care insurance plan for employees as well as all qualified long-term care premiums paid for employees, their spouses, and dependents3. Self-employed individuals may deduct up to the eligible long-term care premium shown above. The definition of self-employed includes a sole proprietor, partner, more than 2% shareholder/employee” of an S-corporation, or a member of a limited liability company. For a self-employed business owner, this deduction is an above the line deduction, so it is not necessary to itemize and meet the 7.5% of AGI floor in order to obtain any tax benefits.

EXAMPLE: John, age 63, owns his own consulting firm. His long-term care insurance premium is $4,000 per year. He is eligible to deduct up to $4,520, the eligible premium amount for 2021, and therefore, he can deduct his entire $4,000 premium. This deduction is also available for the business owner’s spouse as well.

C-Corporations

The premiums are deductible by the corporation without regard to the limitations applicable to individual taxpayers or self-employed individuals4. In addition, the employer’s contributions toward the cost of the long-term care premiums are not included in the employee’s taxable income and the LTC benefits are received income tax-free5. In short, the corporation can deduct the full premium and the employees including shareholder-employees of a “C” Corporation do not need to include the LTC premium in their taxable incomes. This deduction and exclusion from income is also available for retired former employees and for employees who were laid off. In order to exclude the contributions from income, there needs to be an employer-employee relationship. Thus, premiums paid on behalf of an independent contractor or for non-employee members of the company’s Board of Directors would not appear to qualify for the exclusion.

Long-term care coverage can be provided to a select group of employees without jeopardizing the employer deduction or the employee exclusion from income. A plan may cover one or more employees and there may be different plans for different employees or classes of employees. Almost any reasonable classification can be used. Thus, while the plan must be for the sole benefit of employees, the employer can generally pick and choose the employees to whom it will offer this benefit as long as it meets the general non-discrimination rules applicable to health insurance. Note, however, that premiums paid by an employer for long-term care insurance for stockholder-employees, without regard to their employment classification, might be taxable to the insured stockholder-employee. In fact, the premium payments could be characterized as dividends. Premiums paid by an employee through payroll or any type of salary reduction agreement in the workplace must be paid after-tax. LTC insurance is not allowed in a pre-tax, “125” cafeteria plan6.

Long-Term Care Riders

Long-term care insurance contracts can be attached as riders to life insurance contracts and annuity contracts. The charges for long-term care insurance contracts attached as riders are not includible in income if they are subtracted from the cash value of the base contract. This will allow long-term care insurance to be paid for, using pre-tax dollars, with the cash value of life insurance or annuity contracts. The investment in the contract is reduced by the amount of the charges.

Expanded Tax-Free Exchanges

The Pension Protection Act (PPA) created substantial tax advantages for funding LTC benefits with existing funds in life insurance and annuity cash values by expanding the opportunities for tax-free 1035 exchanges7:

- Life Insurance Exchange

Cash value from existing life insurance policies can be exchanged tax-free for a new life insurance policy with expanded LTC benefits. The new policy’s death benefit is still received income tax-free, but in addition, any benefits paid for qualified long-term care services are also received tax-free. - Annuity Exchange

Life insurance cash value can be exchanged into a LTC annuity or a traditional LTC insurance policy. The PPA created a tax incentive for annuity owners to exchange their existing annuities into an LTC-qualified annuity. The gain inside the deferred annuity is taxed as ordinary income when annuitized or when distributions are made. If, however, the annuity’s cash value is exchanged tax-free under section 1035 for an LTC-qualified annuity, and the LTC-annuity’s cash value is used to pay for qualified long-term care expenses, then the gain is not taxed. LTC annuities have simplified or “reduced” underwriting criteria, so these plans are available to many people who have been or may be declined for traditional LTC insurance.

Conclusion

Long-term care insurance policies have changed considerably over the past decade. Companies have increased premiums because of increased life expectancy and some companies have exited this market entirely. Many individuals should seriously consider purchasing a long-term care policy as part of their overall financial and estate plans. The long-term care policy can help ensure that individuals will be able to pay for the long-term care they need while at the same time preserve assets for their families.

The tax information presented here is for general information only and should not be used nor relied upon as specific tax advice. Taxpayers should consult with their CPA or qualified tax professional for advice regarding their own tax situation and the tax status of LTC premiums and benefits.

1 IRC Section 213(a) | 2 IRC Section 162(l)(2)(c) | 3 IRC Section 162(l) | 4 IRC Section 162(l)(2)(c) | 5 IRC Section 106(2)

6 IRC Section 125(f) | 7 IRC Section 1035(a) and Section 1035(b)(4)

The tax information presented here is for general information only and should not be used nor relied upon as speci c tax advice. Taxpayers should consult with their CPA or quali ed tax professional for advice regarding their own tax situation and the tax status of LTC premiums and bene ts.